Although several people, like Bill Gates or many epidemiologists, have warned for a long time about the risk for an interconnected world like ours of a pandemic scenario, it is fair to say that the Covid-19 has caught everyone by surprise. As the virus spreads all over the world and as governments are taking unprecedented actions, we are all living day-by-day, often at home, trying to re-invent our ways of working and interacting, whilst hoping that this is only temporary and that we will soon go back to normal.

However, everybody now expects that there will be enough (good) doctors to treat them…

The world is a village and the whole village got sick…

We are all social animals !

Confinement/lockdown forces us to recalibrate our vision of the world…

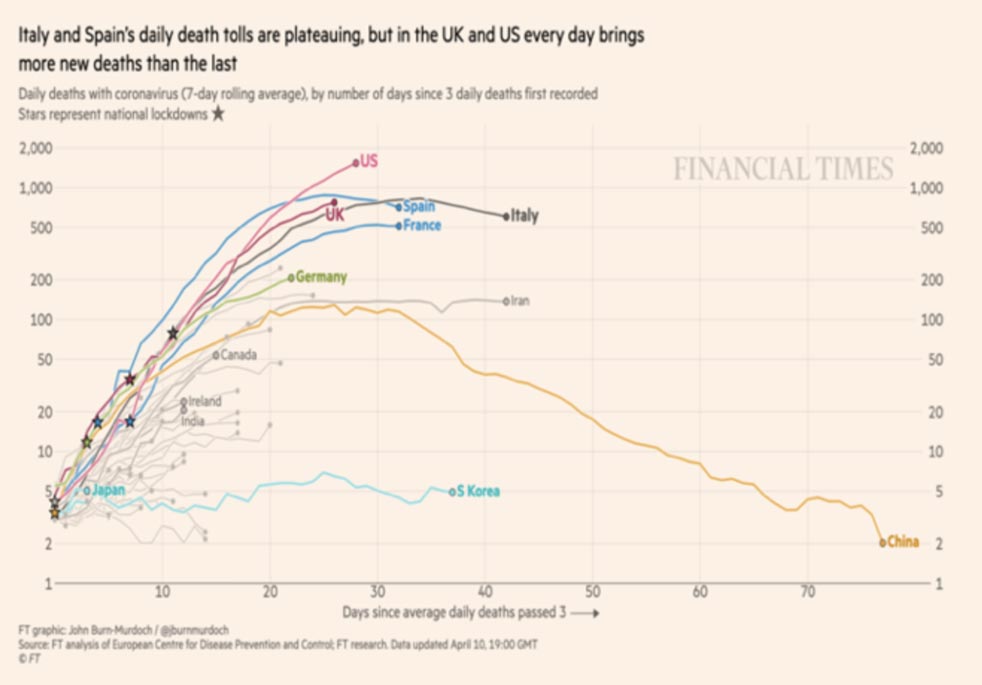

Although the spread of the disease has stabilized in China and South Korea, it is still too early to draw any conclusions on its impacts worldwide, as cases in the US, the UK and other European countries are still ramping up. In fact, few countries have already hit their epidemic peak.

This is true for all of us, and in particular for our entrepreneurs in the AVP portfolios… They are of course very concerned by the impacts of this crisis on their companies and they all ask us what we think, and therefore, what they should do.

Most entrepreneurs and investors, as well as governments remember 2008-2009…

Reactions were quick. Companies know that“cash is king”…

In this environment, it is very important to remain humble and to recognize that there is a huge number of unknowns. So, at this stage, the only thing we can effectively do is build scenarios. Of course, forecasters will forecast, and analysts will analyze. However, past data does not allow us to reliably predict what will happen over the next few months

We also have our own point of view of which scenario is most likely to occur, and we will share it at the end of this paper, but we are also fully aware and acknowledge that there is considerable uncertainty. We are always happy to share our thoughts and reasons to believe in one scenario with our companies, but we also explicitly tell them to consider other outcomes and help them to do so.

Although the risk of a worldwide pandemic has been predicted by many, from a financial market standpoint this crisis is a perfect illustration of the “Black Swan theory”: completely unexpected, outside of any model… But this time, it is not even possible to recalibrate expectations as many factors remain unknown…

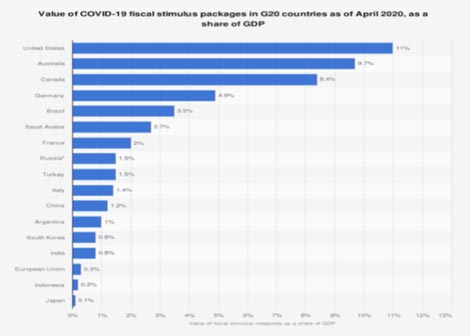

In fact, many different factors will influence the environment in the coming days, weeks and months, leading to a wide range of possible outcomes, from very bad, such as a total collapse of the economy, to rather good with Covid-19 (relatively) quickly put under control, a fast economic recovery and extensive public policy programs. Colossal relief plans have already been announced by governments and central banks all around the world.

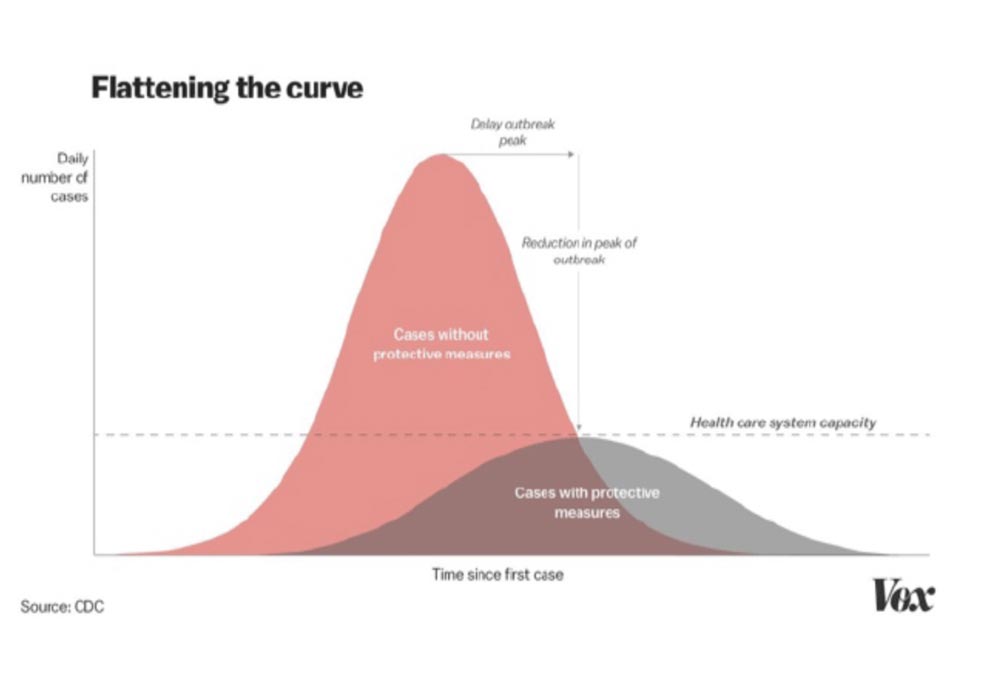

First and foremost, we believe that the key criteria to decide which scenario to favor is how long the various measures of confinement/lockdown, meaning the quasi shut-down of the economy, will last. Indeed, this quasi shut-down implies a severe demand shock and a simultaneous massive supply shock. And these are global shocks; that affect all economies around the world, with in addition, a massive disruption of the global supply chain.

Never in the past have we experienced something like this, not even in 1929, nor during war times. Impact may be somewhat mitigated thanks to government and Central Banks packages, but there are limits to how much government can spend, to how much debt they can raise, and to how much money central banks can print. The longer it lasts, the more irreversible the impact on the economy will be.

Taking care of public deficit is less important than taking care of people…

Economic response strategies everywhere consist in spending money to fight the pandemic, to provide a social safety net to people and support to companies…

Best case scenario

4 to 8 weeks of confinement followed by 2 to 3 months towards normalization.

This scenario implies that confinement measures are actually enforced and respected in most parts of the world. This suggests that a “Korean type approach” with massive testing is effectively implemented at the end of the confinement and that a treatment whose effectiveness has been proven is available. In this scenario, there is probably limited irreversible damage to the economy. Combined with the huge financial packages put together by various government and the even bigger quantitative easing programs announced by Central Banks, there could be a very strong rebound in H2 2020.

Worst case scenario

the crisis drags for months and months.

No real solution before a vaccine is found, which takes at least 18 months. Every time confinement rules are lifted, the virus spreads again and no effective cure is available. The monitoring currently happening in China will provide key information on this. In this situation, the supply and demand shocks are not just temporary, and therefore, the impact on the economy is permanent and irreversible (bankruptcies, destruction of production capacity, etc.). In this scenario, the likelihood of a financial crisis in addition to the economic crisis is significantly increased. This scenario is close to an “end of the world” scenario…

And, in between these two scenarios, depending on where you put the cursor of the length of the confinement/shut down of the economy, there is a full range of outcomes, from mild to catastrophic. In order to assess the potential impact on a start-up, and then, for an overall portfolio, one needs to understand which risks a specific company is exposed to, and for this purpose, to consider three different periods:

1. Short-term / Exposure to quasi shut-down of the economy:

During the confinement/lockdown, the economy is stopped, at the very least in a significant slowdown. For most companies, it means no additional sales and therefore no growth. In addition, depending on their business, they will also start seeing increased churn with their customers. Some companies may also not qualify for government relief, especially in the early stages or in case of a strong reliance on freelancers rather than full-time employees. Consumer-facing industries are expected to be most impacted, as well as automotive players.

A very severe demand shock associated with a very severe supply shock, globally, with deep disruption of the global supply chain… Some sectors suffer greatly, and some may not even recover if this lasts too long…

In a few cases, some companies may benefit from the situation, at least in the short-term, because they contribute to produce or deliver something critical in this environment. This may also be the moment for digital communication tools to expand their customer base beyond early adopters. However, revenues from online advertising are expected to plunge even though higher traffic will partly compensate lower marketing budgets. Online retailers are set to benefit, if they can manage their logistics.

Some are benefiting….

More generally, this crisis could be a real catalyst for faster adoption of digital solutions in businesses, for acceleration of e-commerce (and all associated solutions), for emergence of new digital health approaches…

2. Medium-term / Exposure to economic cycle / Recession:

Following the end of the confinement measures, things will restart, but this may be very slow and gradual, and there will clearly be major economic impacts. It is very likely that the world will be in recession, and the more the economy suffers from irreversible damage during lockdown, the more the recession will be severe. Cyclical companies (or the ones dependent on economic cycles) and those that have “nice to have” rather than “must have” products or services will be the most impacted. This is where churn will happen most acutely, when clients implement cost cutting measures and review their priorities. This is when products/services that do not have very clear short-term ROI will suffer.

3. Medium to Long-term/ Exposure to refinancing risk:

Over the medium to long-term, there will surely be some adjustments to the supply chain organizations, and, at least because of political reactions to the crisis, some parts of the supply chain, for some industries, will be readjusted. But the key unknown is the situation of the financial system. So far, the economic crisis has not yet translated into a deep financial crisis (in the sense that, despite the drop of the equity market and the lack of liquidity in most market segments, banks and financial institutions have not shown signs of weaknesses). This is also the result of the 2008 crisis and the fact that balance sheets have been significantly strengthened.

Bank balance sheets are in a much stronger position than before the Great Financial Crisis of 2008. No serious signs of weaknesses have been observed so far.

This is a key factor for hope of a strong rebound.

We therefore have a few beliefs:

- All companies should do whatever it takes to preserve their cash first, reduce their cash burn as much as possible while still being able to bounce back (restart their activity) quickly when the confinement is lifted. They should also have a very clear and well thought-out plan post-confinement. In particular, key challenges will be to avoid churn as much as possible. Therefore, adequate communication plans should be carried out, so that when clients take cost cutting measures (which are unavoidable), they have heard the “must have” arguments before hand.

Companies, assisted by consulting firm and pushed by investors, are actively looking at ways to preserve their cash.

(Source: McKinsey & Company, Covid-19: Implications for Business, March 2020)

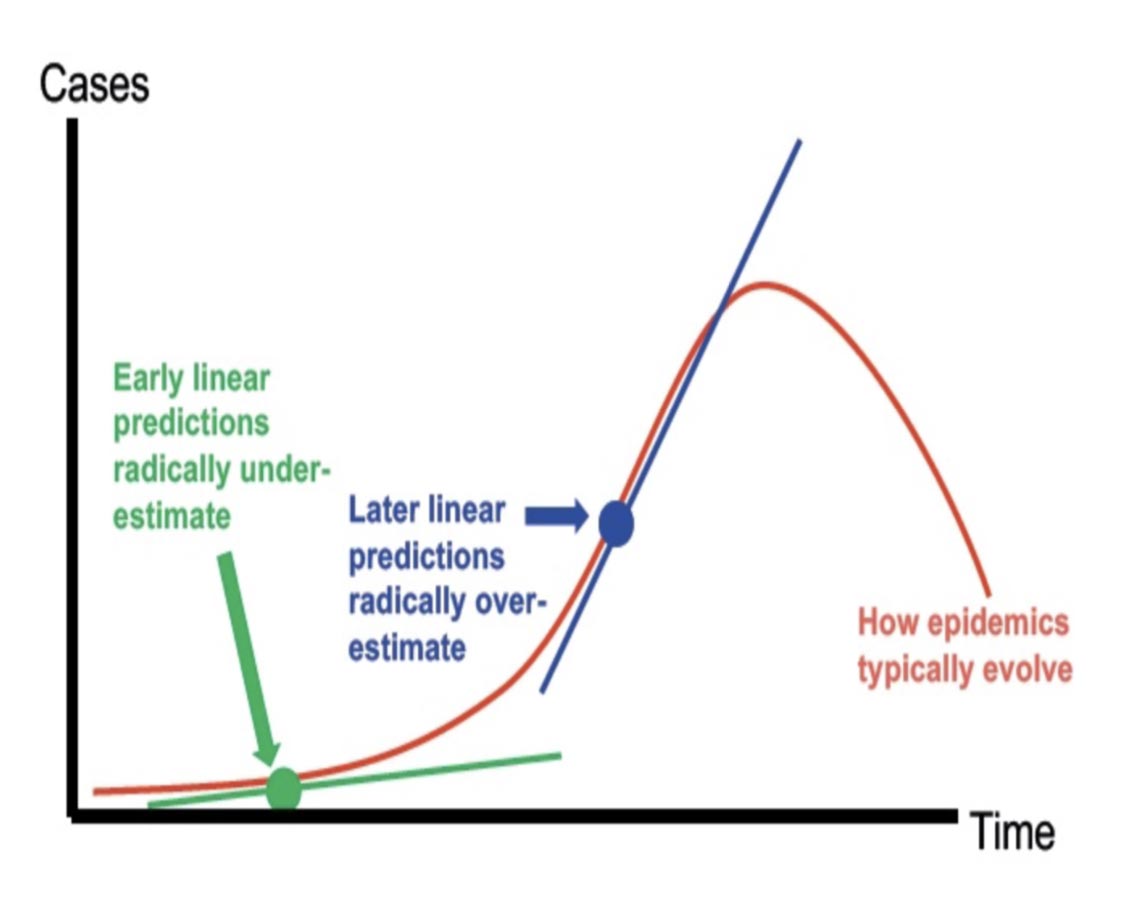

- Although predicting the future is impossible, we still want to keep an optimistic, but realistic stance by favoring the best-case scenario: relatively short confinement, quick normalization and big and impactful economic and fiscal stimuli from governments and Central Banks. In that case, the macro-economic impact will be limited. The reason for favoring this scenario is not particular data nor additional information, but lessons learned. By reflecting on what happened in past crisis, we usually tend to overestimate short-term impact because we overweight current information and context and underestimate the possible range of longer- term scenarios. And, although there are also potential negative factors that could further deteriorate the situation, it is possible that positive trends materialize. Indeed, the more the world fights this crisis through research and innovation, the more likely it is to have new insights and findings that have not been taken into account yet.

Human tend to favor linear projections, which very often mis-estimate short-term and long-term impacts.

- In this scenario, the loss of output in Q1-Q2 will be partially offset by the rebound of activity in Q3, but even more in Q4. Companies that have been able to protect their position and keep a close dialogue with their customers will go back to their previous activity levels. There is no financial crisis and given the huge liquidity that has been injected in the economy, VC and growth markets will resume slowly and eventually (in 2021) go back to where they were in mid-February. So, overall, we would have lost one year, but this is not a 2008 crisis during which there was very little investment activity for a few years. This is our scenario. And in this scenario,“winter has not come”or at least it is a very short winter and we will enjoy the spring.

- However, we also recognize that there are so many uncertainties and that the probability for this scenario to occur clearly does not reach 90%. The development of the situation in the coming weeks is critical and will bring crucial information:

-

- ▪ How the confinement policies are observed / managed?

-

- ▪ The availability, at scale, of testing and monitoring solutions

-

- ▪ The emergence and the medical validation of an effective cure (and the availability of and access to this treatment).

-

- ▪ The situation in China, and later in Italy and Germany, when these countries lift confinement (does the virus spread again or not?). Indeed, it is too early to draw any conclusions, as signs of recovery from China, such as industrial production and cities traffic reaching 80-90% of pre-Chinese New Year levels, are mitigated by slowed exports pushing factories to lay-off suspended workers. In addition, fears of a second wave have delayed the re-openings of client-facing businesses.

-

If one or more elements of our best-case scenario do not materialize, then things will be much more difficult. So, despite the fact that we believe that the worst is not certain, we also believe it is good practice for our companies in this climate to prepare for a worst-case scenario. If this worst case does not happen, it will be a good surprise and everybody will be very happy!